Introduction to Travel Insurance for Cyprus

Travel Insurance for Cyprus,when planning a trip to Cyprus, ensuring you’re prepared for unexpected events is just as crucial as organizing your flights and accommodations. Travel insurance acts as a safeguard, protecting you from potential financial losses or complications that could arise during your journey.

Cyprus, with its mix of vibrant cities and serene coastal areas, offers unique experiences, but even the most well-organized trip can face challenges like delayed flights, lost belongings, or sudden health issues.

Having travel insurance tailored to your needs ensures that you’re covered in case of such disruptions. Whether you’re visiting Cyprus for a relaxing beach holiday, historical exploration, or outdoor activities, selecting a policy that aligns with your travel plans is essential.

It’s not only about convenience but also about mitigating risks, especially when it comes to medical emergencies or unexpected itinerary changes.

Moreover, travel insurance can provide valuable support, from reimbursing non-refundable costs to offering assistance services while abroad.

Policies that combine essential coverage with flexibility will allow you to focus on enjoying all that Cyprus has to offer without the added stress of worrying about potential setbacks.

Understanding Travel Insurance Policies

Travel insurance policies are built around a few key components, each designed to address different aspects of travel risks. The most common features include coverage for trip cancellations, interruptions, medical emergencies, lost or delayed luggage, and unforeseen delays.

For those traveling to Cyprus, it’s worth paying special attention to the medical coverage component, particularly if you plan on engaging in activities like swimming, diving, or hiking, which could carry a higher risk of injury.

Another critical aspect of travel insurance is understanding how claims are processed and what documentation is required. Some policies might have stricter requirements or longer processing times, which can be a deciding factor depending on your travel style.

Certain insurers also provide a 24/7 helpline, which can be a lifesaver when dealing with situations in a different time zone or language.

It’s also important to note that coverage limits and exclusions vary significantly between providers. For example, some policies may exclude specific scenarios like injuries from extreme sports or coverage for high-value personal items unless you’ve added additional riders.

In addition, travelers with pre-existing medical conditions may need to explore policies that explicitly cover such cases, ensuring their needs are fully addressed.

Customizing a policy to your travel plans ensures that you’re not paying for unnecessary add-ons while still being protected in the areas that matter most.

Balancing these elements with the premium cost is key to selecting a policy that provides both value and peace of mind for your trip to Cyprus.

Best Travel Insurance for Cyprus

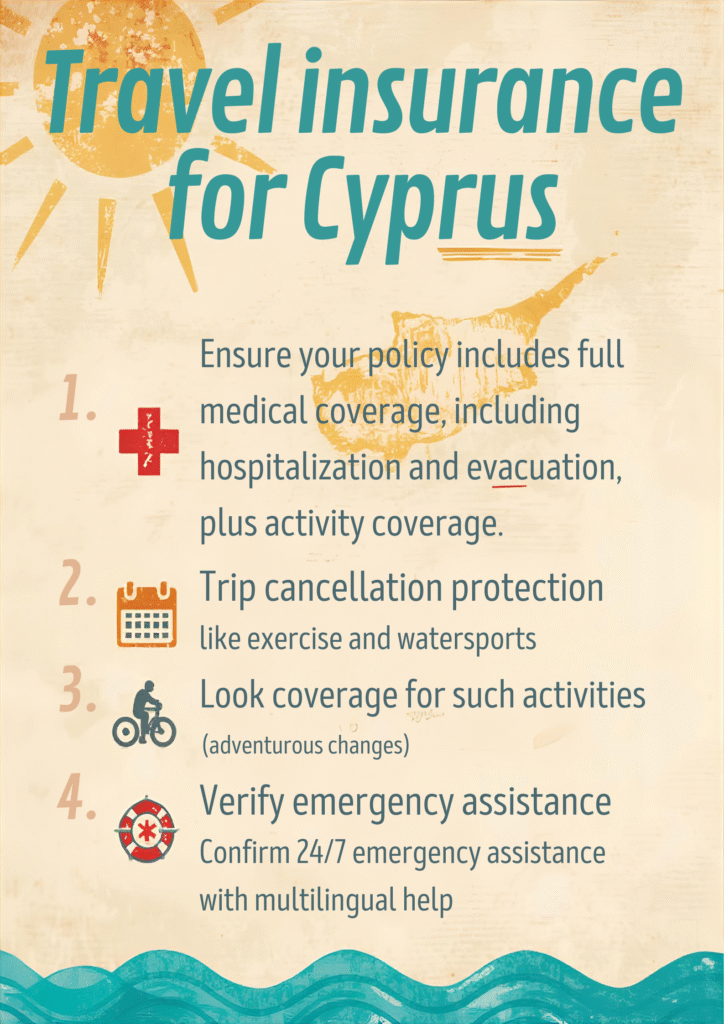

Choosing the right travel insurance for your Cyprus trip involves assessing your needs and understanding what different providers offer. Policies that prioritize medical coverage, trip cancellations, and emergency assistance are often the most valuable.

Medical expenses can add up quickly when traveling abroad, and a policy that includes emergency evacuation ensures you’re prepared for worst-case scenarios.

Beyond medical coverage, trip interruption protection is essential for safeguarding non-refundable expenses like accommodations and flights in case of unexpected disruptions.

Travel insurance providers such as Allianz, AIG, and World Nomads are known for offering comprehensive plans that cater to a range of travelers, from solo adventurers to families.

These companies provide flexible options, allowing you to tailor your policy to match your travel style. Additionally, many of their plans include 24/7 customer support, which can be crucial if you encounter issues during your trip.

Some providers even offer specialized plans for travelers engaging in specific activities or requiring higher coverage limits for valuable items. For example, if your itinerary includes activities such as scuba diving, you may need to add coverage for sports-related risks.

Similarly, travelers carrying expensive equipment like cameras or laptops can explore options to ensure these items are protected.

By comparing the features of these plans, you can identify one that aligns with your priorities while ensuring you’re covered for the unique aspects of your Cyprus adventure.

Affordable Travel Insurance Options

Exploring affordable travel insurance options for a trip to Cyprus involves striking a balance between cost and the essential coverage you need.

Start by identifying your priorities whether it’s medical coverage, trip cancellation protection, or coverage for lost items and focus on policies that address these areas without unnecessary extras.

Many providers offer basic plans that cover key concerns while allowing you to add optional benefits if needed, helping you stay within your budget.

Consider factors such as deductibles and policy limits when comparing plans. Opting for a slightly higher deductible can lower your premium, though this means you’ll pay more out-of-pocket in case of a claim.

Some insurers also offer discounts for purchasing a policy early or bundling it with other types of insurance, such as health or auto coverage.

Online comparison tools like Squaremouth and InsureMyTrip simplify the process of evaluating multiple plans side by side, enabling you to review features and costs quickly.

These platforms allow you to filter policies based on your budget and requirements, making it easier to identify an option that aligns with your needs.

Additionally, consider the type of traveler you are. For instance, solo travelers may benefit from plans focusing on emergency assistance, while families might prioritize coverage for children at no extra cost.

Tailoring your policy to your travel habits can ensure comprehensive protection without overspending.

Cyprus Trip Insurance with Medical Cover

Medical coverage is one of the most vital aspects of travel insurance, particularly for international trips. While enjoying the rich culture and stunning landscapes of Cyprus, it’s important to be prepared for medical scenarios that could arise unexpectedly.

Policies offering comprehensive medical benefits typically cover expenses for doctor visits, hospitalizations, prescription medications, and even emergency transportation. These features are particularly useful if you encounter sudden illnesses or injuries during your stay.

For travelers with specific medical needs or pre-existing conditions, some insurance providers offer plans that cater to these situations, ensuring you’re not left with out-of-pocket expenses for necessary care.

Additionally, medical evacuation benefits can prove essential in cases where you may need specialized treatment that isn’t available locally. These plans are especially important for activities like hiking or exploring remote areas where medical facilities might not be easily accessible.

It’s also worth noting that certain policies provide coverage for dental emergencies, which can be a valuable addition for peace of mind while traveling. Before purchasing a plan, carefully review its medical coverage limits and any exclusions that might apply.

Comparing options from established providers like GeoBlue, IMG, or Allianz can help you find a policy that aligns with your health needs and ensures reliable access to care throughout your Cyprus trip.

How to Compare Insurance Plans

Comparing travel insurance plans requires a clear understanding of your travel needs and the specifics of each policy. Start by identifying the areas where you need the most protection, such as medical emergencies, trip cancellations, or coverage for personal belongings.

Review the coverage limits closely, ensuring they align with the potential costs you might face during your trip to Cyprus.

Pay attention to policy exclusions, as these can vary significantly between providers. For example, some plans may not cover adventurous activities or pre-existing medical conditions unless explicitly stated.

It’s equally important to evaluate the claims process look for policies with straightforward procedures and reliable customer support in case you need to file a claim while abroad.

Consider the reputation of the insurance provider by reading reviews from other travelers. Providers with high customer satisfaction ratings often indicate better service quality and faster claims resolution.

Additionally, online comparison tools can help you assess multiple policies side by side, allowing you to filter options based on your specific requirements.

Finally, take note of additional features, such as 24/7 helplines or multilingual assistance, which can be particularly helpful when traveling in a foreign country. By approaching the comparison process methodically, you’ll make a more informed choice.

Tips for Purchasing Travel Insurance

Purchasing travel insurance requires careful consideration to ensure your policy fits your needs. Begin by thoroughly assessing the specific risks associated with your Cyprus trip, such as medical emergencies, trip disruptions, or coverage for personal belongings.

It’s important to choose a plan that offers sufficient protection in the areas you prioritize most.

Take the time to read the fine print of any policy before committing. Pay close attention to exclusions, as these can significantly impact what is covered, especially if your itinerary includes higher-risk activities or you have pre-existing medical conditions.

Additionally, compare coverage limits across providers to ensure they adequately cover potential costs without leaving gaps.

Timing matters when buying insurance. Securing a policy early right after booking your trip often provides the most comprehensive protection, especially for unexpected cancellations.

To save on costs, explore bundling discounts or consider raising your deductible if you’re comfortable with a higher out-of-pocket expense.

Lastly, consider the customer service reputation of the insurer. Reliable support during emergencies can make a significant difference, especially when dealing with unfamiliar systems abroad.

By reviewing policies carefully and comparing options, you can confidently choose the right travel insurance to complement your plans for exploring Cyprus.